Energy Innovation partners with the independent nonprofit Aspen Global Change Institute (AGCI) to provide climate and energy research updates. The research synopsis below comes from AGCI Executive Director Dr. James Arnott, and a full list of AGCI’s quarterly research updates covering recent climate change research on clean energy pathways is available online at https://www.agci.org/solutions/quarterly-research-reviews

One bright spot amid the past quarter was Britain’s record-breaking 67 days of coal-free electricity. Remarkably, the birthplace of coal-based industrialization met power demands for more than two months without firing up a single coal plant. Although encouraging, the exceptionalism of this news highlights the lengths we still have to go.

Rapid coal phase-out is a key part of limiting warming below 2°C, and new research provides insight into how that could happen. A mix of climate and non-climate factors, as well as market and non-market drivers, are key to charting out a speedy and equitable transition.

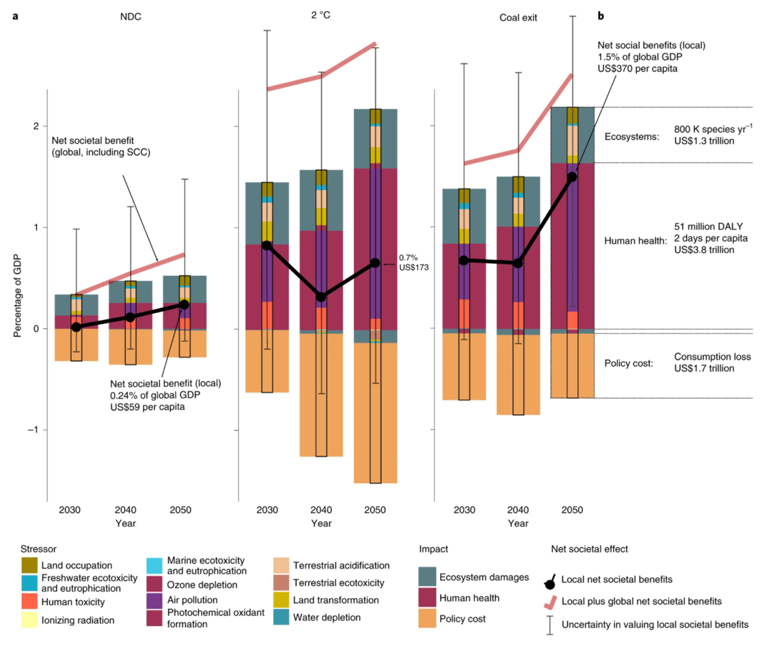

In Nature Climate Change, a group of researchers led by Sebastian Rauner of the Potsdam Institute for Climate Impact Research account for the non-climate local benefits of a coal exit. Their study meticulously sums monetized estimates of coal damages to nearby ecosystems and human health, comparing those with the direct policy costs of different phase-out scenarios. Aggregating to the global scale, they find a rapid “coal exit” scenario produces net societal benefits of $3.4 trillion, or 1.5 percent of global GDP. These benefits also occur, albeit diminished, under scenarios of meeting a 2°C target or the less ambitious coal phase-out scenario consistent with Paris accords. The authors find that many (though not all) regions see net gains without considering any climate benefits, and all regions of the world see substantial net economic benefits when adding in the social cost of carbon at $100 per ton (see bold pink line in Figure 1). While this analysis showcases how many regions could find extra motivation to ditch coal, their study ultimately relies on non-market based evaluations, such as valuations of human life-years and willingness to pay for ecosystem functions.

Figure 1 a, Direct annual policy cost, globally aggregated values of local health/environmental effects across policy scenarios relative to reference scenario. Direct annual policy cost is derived from macroeconomic consumption loss, human health impacts are valued through willingness-to-pay metric, environmental damages are valued through restoration cost. Inner bars show cost/benefits for different categories (stressors). Outer (thick) bars stressors are grouped by categories: ecosystem damages, human health, direct policy cost. Solid black lines indicate resulting net societal effect: aggregated local co-benefits minus direct policy cost. Red lines add global benefits in the form of social cost of carbon of $100 per ton CO2 to net societal benefits. Whiskers indicate uncertainty ranges of net societal benefit from translation of human health and environmental impacts into social cost. b, Benefits of coal-exit scenario for year 2050 in absolute terms. Caption adapted from Rauner et al., 2020

Stranded assets are important when it comes to understanding market behavior. Stranded assets are investments that become impossible to recover due to policy changes. Stranded fossil fuel assets can escalate decarbonization costs across the entire economy, and fear of them can galvanize climate policy opposition. Yet it’s unclear whether investors price stranded asset risk into their choices, or whether they assume future policies will include compensation for potential losses. This makes it difficult to estimate the economic cost of different policy options or to design policies that would sufficiently account for investor support or opposition to such policy.

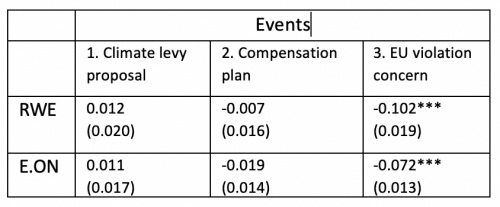

In 2015, three events in Germany provided a fortuitous window into investor behavior about stranded coal assets. The first event was the March 2015 announcement of a “climate levy” policy, which would have effectively shuttered German lignite coal-based facilities. The second event occurred in July 2015 when a modified proposal offered compensation to plant owners for maintaining reserve capacity. The third event occurred in August 2015 when it was reported that a research service of the German parliament assessed that the July compensation proposal might violate European Union laws regarding state aid, calling into question the feasibility of the compensation (but not the levy).

Taken together, these events provide a test case to study investor behavior regarding stranded assets. Two economists at Germany’s Liebniz Institute for Economic Research, Suphi Sen and Marie-Theres von Schickfus, do just that in a study published in the Journal of Environmental Economics & Management. Using an event analysis method, they gather together a wide assortment of data including trading volume and price data for publicly traded companies (i.e., RWE, E.ON) in possession of German lignite coal assets.

The results compare investment returns during each of the three events with estimates of predicted returns. In summary, Sen and von Schickfus found (see Table 1) that the average cumulative abnormal returns revealed no significant changes during or just after either of the first two events. There was, however, a significant drop in returns following the final announcement of possible rule violations that would negate compensation. This signal, after accounting for confounding factors, suggests that investors may be pricing in the risk of stranded assets and expecting compensation for their losses. As such, a significant change in asset pricing begins to emerge only when the specter of losing opportunities for compensation appears, which the authors conservatively estimate cut 20 percent of asset value.

Table 1 This table presents the average cumulative abnormal returns of RWE and E.ON from announcements of each stage of the policy proposal. Event window is five days centered around an announcement. Estimation window is 90 days just prior to the event window. Hence, event window observations are excluded in the estimation of normal market performance. Standard errors are in parentheses. Significance levels re indicated as p < 0.10*, p < 0.05**, p < 0.01***. Source: Sen and von Schickfus 2020.

Aside from the potential costs of stranded assets, energy justice scholars consider the costs of transition (monetary and otherwise) from a broad variety of equity considerations. These include how transitions might affect national and local economies, employment, public revenues, and local environmental and health impacts. As each of these factors are considered, costs and benefits of different phaseout timelines can be identified.

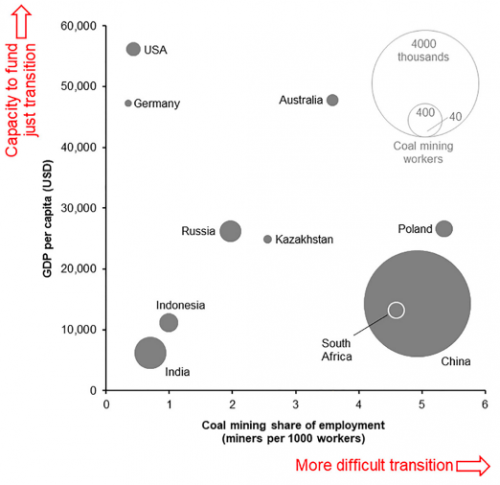

Figure 2 Coal mining share of employment versus per-capita GDP (PPP), selected countries, 2015 (or nearest year for which data available). Size of bubbles reflects absolute number of coal mining workers. Source: Muttitt and Kartha 2020.

A new article in Climate Policy by Greg Muttitt and Sivan Kartha, respectively of Oil Change International and Stockholm Environment Institute, provide a framework for considering principles of an equitable phaseout of fossil fuel extraction, including coal. They illustrate a diverse landscape of transition pathways worldwide, with substantially different capacities between countries. For instance, plotting country GDP per capita vs. number of workers engaged in coal mining (Figure 2), highlights thorny justice implications of coal transitions.

On the one hand, lower capacity regions with higher shares of coal workers could be prioritized for a more lenient pace of transition. But on the other hand, delaying the timeline for phasing out coal in countries like China and India would pose significant global and local climate and environmental impacts, not to mention the health impacts to coal workers retrained and other delayed co-benefits of transition (see June 2020 Research Review from Jack-Scott).

The authors raise a series of questions to help guide an equitable phaseout:

- How should climate change impacts on vulnerable people be balanced with transition impacts on those dependent on fossil fuels (extraction, use)?

- How should the negative impacts of current fossil fuel extraction be incorporated?

- Who should undergo the fastest transition?

- Who should pay the costs of the transition?

The authors use this standpoint of limiting climate risk to offer a five-fold set of principles for equity in transition:

- Phase down global fossil fuel extraction at a pace consistent with limiting warming to 1.5°C

- Enable a just transition for workers and communities

- Curb fossil fuel extraction consistent with environmental justice

- Reduce fossil fuel extraction fastest where social costs of transition are lowest – economies least dependent on extraction and with the greatest resources to absorb the transition

- Share transition costs fairly, according to ability to bear those costs

Principles like these depict a more multi-faceted set of factors that could motivate, constrain, and ultimately embody a swift and just coal exit. This tension between market and non-market costs, and the distributional burden between global and local impacts get mixed together in ways that complexify the opportunity for a swift and just coal phaseout, while deepening attention to justice implications.

Despite the many well-documented deficiencies of coal-based energy, a just and swift transition away from coal is still not a foregone conclusion. China, for example, could still add hundreds of gigawatts of coal generating capacity before its planned emissions peak in 2030, a trajectory that would be devastating to global climate goals. Nevertheless, the demonstrated progress in places like Britain remains a beacon of hope, and opportunities abound to consider the particular interests of local entities and investors while establishing broader frameworks oriented around collective well-being.

Rauner, S., Bauer, N., Dirnaichner, A., Dingenen, R. Van, Mutel, C., & Luderer, G. (2020). Coal-exit health and environmental damage reductions outweigh economic impacts. Nature Climate Change, 10 (April). https://doi.org/10.1038/s41558-020-0728-x

Muttitt, G., Kartha, S., & Muttitt, G. (2020). Equity , climate justice and fossil fuel extraction : principles for a managed phase out phase out. Climate Policy, 0 (0), 1–19. https://doi.org/10.1080/14693062.2020.1763900

Sen, S., & Schickfus, M. Von. (2020). Climate policy , stranded assets, and investors ’ expectations. Journal of Environmental Economics and Management, 100, 102277. https://doi.org/10.1016/j.jeem.2019.102277