Energy Innovation partners with the independent nonprofit Aspen Global Change Institute (AGCI) to provide climate and energy research updates. The research synopsis below comes from AGCI Research Director Julie A. Vano, and a full list of AGCI’s quarterly research updates covering recent climate change research on clean energy pathways is available online at https://www.agci.org/solutions/quarterly-research-reviews

Extreme weather events. Supply-chain shortages. Economic fallout. The disruptions of the past two years are increasing unease about future risks among global policymakers, prompting more careful consideration of how to include climate change in risk assessments.

Business leaders are among those rethinking how they evaluate climate risk. The Task Force on Climate-related Financial Disclosures (TCFD), a group established by the Financial Stability Board to develop a framework for disclosing climate risks and opportunities, released a 2017 report that explains two types of climate-related risks businesses can face: First, risks related to the transition to a lower-carbon economy, including changing customer behavior, costs to adopt lower-emissions technologies, and increased exposure to litigation. Second, risks related to doing business in a changing physical environment, including increasingly severe extreme weather events, changing precipitation patterns, rising temperatures, and sea-level rise. Both types of risk vary considerably based on business type, size, and location.

As awareness of these types of climate risks grows, more businesses are struggling to quantify climate change impacts and source the data needed to help evaluate the risks identified by the TCFD. In recent years, the number of organizations pledging to support the TCFD’s landmark 2017 recommendations for disclosing information about climate risks and opportunities has increased rapidly. As of October 2021, these organizations included 1,069 financial institutions responsible for assets of $194 trillion (2021 TCFD).

To address businesses’ growing thirst for climate-related financial risk information, Tanya Fiedler of the University of Sydney Business School and Andy Pitman of the Climate Change Research Centre, UNSW, Sydney, mobilized an interdisciplinary team with climate science, accounting, and business expertise. In their 2021 perspective on “Business risk and the emergence of climate analytics” for Nature Climate Change, Fiedler and colleagues outline the challenges and suggest a new path to improve the use of climate science to inform how businesses assess their climate-related financial risk.

Petabytes of tempting data

Climate scientists often use global climate models (or Earth system models) to understand climate change impacts. These models represent physical laws captured in computer code and simulated on supercomputers at research centers around the world. They help climate scientists better understand how greenhouse gases are increasing surface temperatures, how hydrologic cycles are amplified by warming (making wet periods wetter and dry periods drier), and how landmasses and the Arctic are warming more rapidly (Palmer and Stevens 2019).

Over the years, global climate models have provided more simulations, at finer spatial resolutions, generating petabytes of data (one petabyte could hold 4,000 photo downloads a day for a lifetime). Open-access data from these models are available online and may seem to offer a crystal ball for businesses to assess their future climate-related risk.

In reality, identifying and applying fit-for-purpose climate model data appropriately is a major challenge that, while not new, is more important than ever. As Fiedler and colleagues point out, “the misuse of climate models risks a range of issues, including maladaptation and heightened vulnerability of business to climate change, an overconfidence in assessments of risk, material misstatement of risk in financial reports and the creation of greenwash.”

Mismatched tools

While climate scientists and economists both use models to better understand future conditions, their modeling platforms and how the data outputs should be interpreted are very different. For example, climate models generate data by solving equations, which provide highly precise numbers. This precision is a modeling artifact and should not be confused with accuracy. Not acknowledging this or many other nuances could result in a false sense of security. As such, the use of global climate model data to assess climate-change risk must be done with careful consideration.

Fiedler and colleagues outline numerous qualifiers and precautions to prevent misuse of global climate model output at different spatial and temporal scales.

- For climate information used for analysis at global and continental scales in 2050 to 2100: Global climate model simulations are designed for this regional extent and time period. An ensemble of independent models can be used to estimate projected temperature changes and their range of uncertainty, focusing on average changes. Global models should not, however, be relied on to capture low-probability, high-impact events.

- For analysis at smaller-than-continental scales: Most global climate model simulations divide the globe into pixels of around 100 x 100 kilometers or coarser. The data they produce is not intended to be used to evaluate change in a specific location or physical asset. Techniques that “downscale” the information using dynamical or statistical methods can add value but should be employed with keen attention to the value (and biases) the new information provides.

- For analysis in 2020 to 2050: Global climate models simulate climate variability, capturing the natural swings in warmer/cooler or wetter/drier periods at sub-regional scales that can last a decade or two. As such, it is difficult to distinguish the differences between higher- and lower-emissions pathways before mid-century.

- For analysis of climate extremes: Extreme events, by definition, are rare and therefore less well understood. Important research is underway to explore how 1-in-100-year events are simulated in global models, but results are not robust enough for most applications, especially in the context of business decisions.

- For analysis at the scale of a physical asset: For all the reasons outlined above, the information most desired in financial decision making—local changes in extreme weather events—is not what global climate models provide. Fortunately, there are alternative ways to assess climate impacts, but these can require careful region- and investment-specific evaluations.

A better way to match climate information with risk analysis

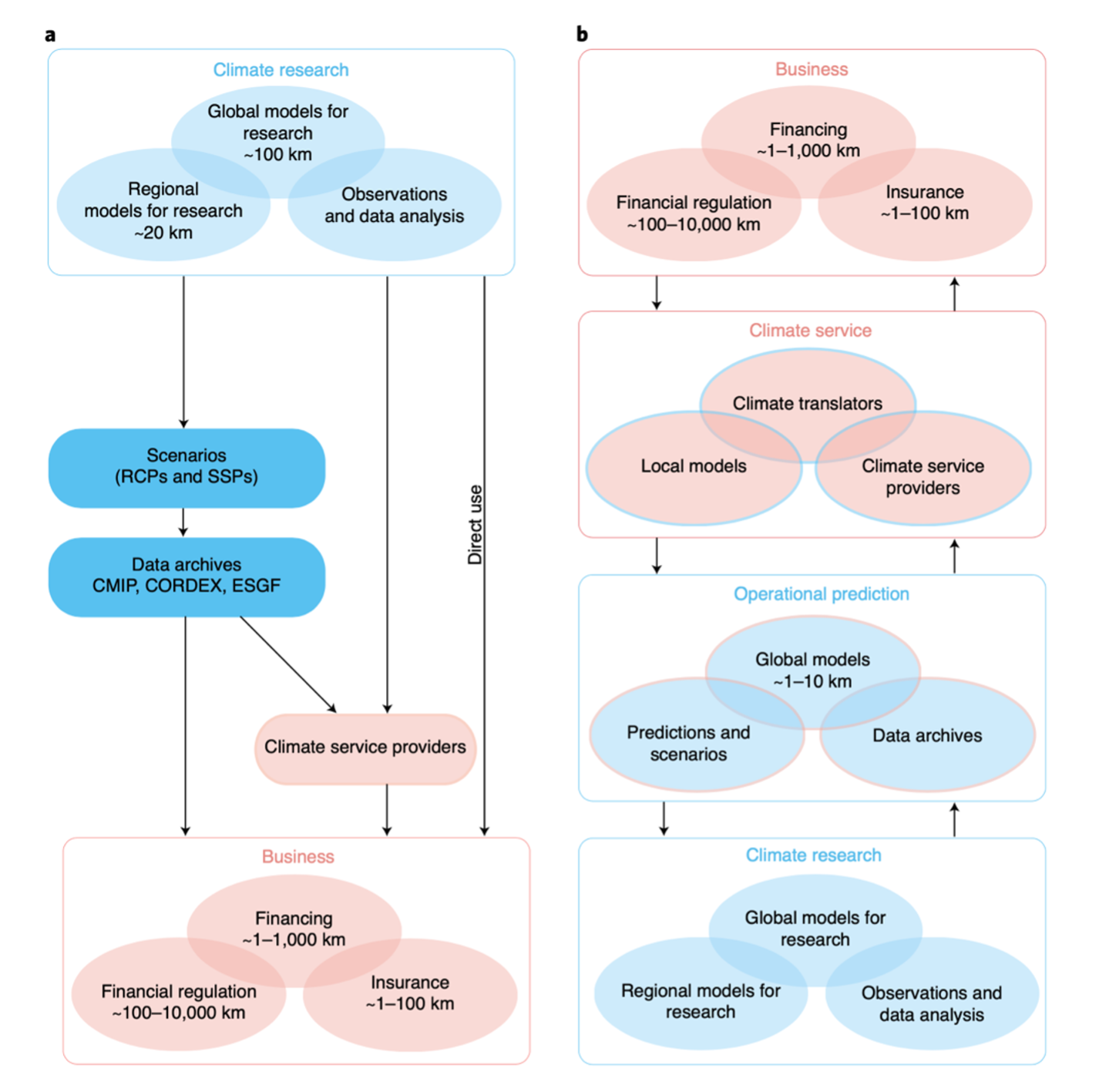

While the direct use of climate change data may not be a panacea, Fiedler and colleagues chart a path (Figure 1b) showing how climate science can help businesses and their investors, lenders, and insurance underwriters make informed economic decisions.

In their paper, the authors illustrate the current approach to connecting climate research and business (Figure 1a), where information usually flows in one direction. In some cases, climate service providers, sometimes in collaboration with financial sector experts (e.g., asset managers, banks, credit rating agencies), assist by combining information with other data to help assess an entity’s risk profile. However, those types of analyses are too often proprietary, and their scientific merit is difficult to assess.

As an alternative, Figure 1b illustrates how climate projections could be professionalized to inform business needs. Using both “climate service” and “operational prediction” intermediaries would provide mechanisms to facilitate the flow of information in both directions, as indicated by up and down arrows and the mixing of pink and blue at the boundaries.

This new paradigm emphasizes the need for more effective communication between business and climate science and reliance on expert judgment. Fielder and colleagues propose establishing “climate translators” as a new group of professionals who could help operationalize climate services by facilitating more direct engagement between climate scientists and businesses and bringing greater transparency to the value and limits of climate model information for business purposes.

Also, while climate models will continue to advance, it is wise not to wait for better information from them. Instead, there are alternative ways to use existing climate science to assess financial risks and minimize vulnerabilities. For example, examining how one’s business has been affected by weather variability in the past (five to 10 years, and longer if possible) can help uncover how specific events disrupt operations and supply chains and provide information that can be used to limit those vulnerabilities in the future.

A path forward

The increased awareness and desire to better understand a business’s climate risk has elevated the importance of both climate mitigation and adaptation. However, doing this work well requires more understanding of how to meet the financial sector’s needs. Fiedler and colleagues emphasize this will not simply be solved by open access to data or by climate service providers re-packaging information. Instead, they call for a redesign: “To meet the needs of the financial sector, regulators and business, climate projections need to be developed, undertaken and provided at the same level of professionalism as weather services.”

This call to action is being echoed by others in the financial sector and beyond. The TCFD (2021) reported that the key challenges for those preparing financial impact disclosures were difficulties in obtaining relevant climate risk-related data and selecting and applying assessment methodologies. Of note, these challenges were reported three times more often than other challenges related to financial impact disclosure including disclosure requirements or lack of buy-in from organizations.

Similar dialogues are underway in the water sector (Addressing the “Practitioners’ Dilemma”: Climate Information Evaluation for Practical Applications in the Water Sector) and energy sector (Navigating the Clean Energy Transition in a Changing Climate). These efforts are taking stock of ongoing work to produce decision-relevant climate information, evaluate the fitness of that information, and characterize its uncertainty in ways that facilitate an entity’s ability to effectively mitigate or adapt to these risks.

Common themes highlighted by these various efforts include the need for increased transparency, the ability to embrace probabilistic thinking, and finding a more systematic approach to assessment of climate science for applications. These needs can be met by more open discourse between the science community and financial sector—an exchange that could help drive scientific innovations that better support what climate-resilient businesses need.

Featured resources

Fiedler, T., Pitman, A.J., Mackenzie, K., Wood, N., Jakob, C. and Perkins-Kirkpatrick, S.E., 2021. Business risk and the emergence of climate analytics. Nature Climate Change, 11(2), pp.87-94

Palmer, T. and Stevens, B., 2019. The scientific challenge of understanding and estimating climate change. Proceedings of the National Academy of Sciences, 116(49), pp.24390-24395

TCFD (Task Force on Climate-related Financial Disclosures), 2017. Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures. https://www.fsb-tcfd.org/recommendations/

TCFD, 2021. Task Force on Climate-related Financial Disclosures: 2021 Status Report. https://assets.bbhub.io/company/sites/60/2021/07/2021-TCFD-Status_Report.pdf