A version of this article was originally published on July 25th, 2017 on Greentech Media.

By Matt Golden

Just about every plan to achieve a clean energy low carbon future includes a large helping of energy efficiency. But while it’s true that efficiency is generally much cheaper than generation, energy efficiency as we know it faces an existential challenge.

The rate at which we’re deploying efficiency is simply not keeping pace with utility and grid needs. But even if we were able to achieve scale, in the current construct, it’s unclear how we would pay for the massive investment required.

Fortunately, there is another way. We now have the data, market, and financing in place to procure energy savings to solve time- and location-specific grid problems. Bundling projects into portfolios turns efficiency into an investor and procurement-friendly product that has manageable and predictable yields.

By treating efficiency as a genuine distributed energy resource (DER) we can stop relying on ratepayer charges and programs and instead unleash private markets and project finance to deploy and fund energy efficiency projects in the same way we do solar, wind and other energy resources — through long term contracts, creating cash flows that can be financed like grid infrastructure through project finance rather than consumer credit.

Efficiency’s existential dilemma

While many of our current efforts are focused on overcoming barriers to demand, the elephant in the room is that if we get efficiency on the rails towards real scale, current ratepayer funded programs will simply run out of money.

According to a recent blog post by ACEEE, combined efficiency investments across every sector of the economy (not just buildings) range from about $60 to $115 billion a year in the United States. A conservative estimate from a 2009 McKinsey report puts the price tag of upfront efficiency investment at $520 billion by 2020.

By comparison, current efficiency program spending hovers around $8 billion a year nationally, resulting in a market program market including private capital of approximately $16 billion. It’s a big number, but compared to capital investment needed to achieve the potential of energy efficiency in America’s buildings which will be counted in the trillions, it’s a drop in the bucket.

Rethinking efficiency in order to engage markets

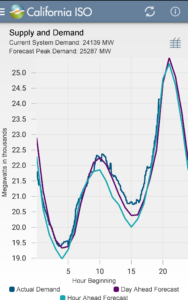

The grid is undergoing a transformation from central generation to clean distributed sources of power such as solar and wind. This has resulted in new challenges as we integrate intermittent renewables, often at the grid edge. The imbalance between California’s daytime solar supply and evening demand (the “duck curve”) is contributing to regular periods of negative pricing and driving the need for time- and location-responsive distributed energy resources (DER) such as storage, EV charging, and demand response. As DER markets emerge, it is clear that there are no silver bullets to solve this problem, and that current resources are both costly and in short supply compared to the scale of the challenge.

Energy efficiency represents the largest and least expensive of these potential resources, but has largely been left out of the conversation. This is because traditional energy efficiency is based on monthly average savings and therefore can’t solve for grid issues that vary by location and time.

However, as smart meter interval data becomes available in an increasing number of states, and portfolios of efficiency projects and data are aggregated, we will have the ability to calculate savings on portfolios of energy efficiency projects in terms of both time and location. This analysis creates resource curves (time and locational savings load shapes) that can be used to design efficiency portfolios that reliably deliver “negawatts” where and when they are most needed, rather than simply average reductions in consumption for a given month.

Rather than paying in advance through rebates for traditional energy efficiency that doesn’t differentiate between peaks or valleys in demand, utilities will be able to procure savings based on when and where they are happening. By breaking down “energy efficiency” into classes of projects that deliver more valuable resource curves, we can make savings worth more when it has the biggest impact, giving market players the tools and incentives they need to optimize their offerings to deliver the most valuable results to the grid and the best deal to customers.

The existential question

With utilities and wholesale market procurement providing a long-term and scalable buyer, the next question is: how do we finance the massive upfront investment required to achieve the energy efficiency potential locked up in America’s existing building stock?

By making efficiency work like other capacity resources, we solve for two of the outstanding existential problems that have stood between energy efficiency and its potential: how to bring efficiency to bear as a real solution for modern day grid issues such as intermittent generation, and how to attract the private investment required to get us there.

Rather than paying rebates upfront and measuring monthly outcomes years later — resulting in prescriptive programs and costly regulations — utilities can use standard open-source methods and calculations such as CalTRACK and the OpenEEmeter to establish markets in which a wide range of businesses can enter into mid- or long-term contracts, similar to supply side PPAs, where they are paid for performance through savings purchase agreements (SPA) for the value of how they shift load over time, based on normalized metered savings.

A new pay-for-performance arrangement would flip the way we pay for energy efficiency on its head. Whereas today energy efficiency investments are financed by consumers either out of pocket or based on their credit or the value of their asset, we can instead use project finance in the same way we pay for power plants and other distributed resources — by paying for performance over time and financing the resulting cash flow. Rather than relying on individual consumers to subsidize the public benefits of efficiency, the costs would be spread across all ratepayers and would be rate-based like other utility investments.

The solutions we need are available today

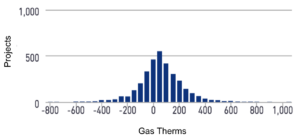

While it’s true that energy efficiency on individual buildings can be all over the map, at the portfolio level it makes for a remarkably stable investment. The transition from attempting to be right all the time to instead accepting quantifiable risks and managing performance through portfolios marks a transition from engineering to finance.

To put it another way, while guaranteeing outcomes to a single customer is exceptionally hard and costly (and has diminishing returns), a portfolio of projects will perform with consistent results, providing purchasers with high confidence in performance and yielding consistent returns for investors. Combined with investment grade insurance products to backstop the performance of bundled portfolios of efficiency projects, financing cash flows of efficiency portfolios works exactly like other grid infrastructure investments.

To put it another way, while guaranteeing outcomes to a single customer is exceptionally hard and costly (and has diminishing returns), a portfolio of projects will perform with consistent results, providing purchasers with high confidence in performance and yielding consistent returns for investors. Combined with investment grade insurance products to backstop the performance of bundled portfolios of efficiency projects, financing cash flows of efficiency portfolios works exactly like other grid infrastructure investments.

Efficiency aggregators compete to enter into savings purchase agreements to deliver demand reductions to utilities when and where they need them. Utilities pay for these savings as they are delivered through procurement. Aggregators can then insure and finance these cash flows and compete to deliver products that both resonate with customers and are optimized to maximize the grid value. So long as efficiency is cheaper than the marginal costs of alternatives such as generation, storage, or transmission and distribution investments, it is a good deal for ratepayers.

Paying for performance in practice

While this approach sounds far-fetched and futuristic — it isn’t.

Everything needed to quantify the impact of energy efficiency resource curves, engage private capital, and manage performance risk is ready to go. The only thing left is for regulators and utilities to establish open and competitive markets to give investors and business model innovators a place to play.

In response to CA law’s AB-802 and SB-350, which requires pilots in normalized metered efficiency and pay-for-performance, PG&E recently selected winning bidders for its first pay-for-performance pilot in which aggregators will be paid based on metered performance over time, rather than through customer rebates and time and materials to implementors. The pilot also represents a first step towards using efficiency to help to close the 4,000 GWh capacity gap created by the planned shutdown of the Diablo nuclear plant in 2025.

Pay-for-performance efficiency isn’t just limited to California. Similar efforts are getting underway in New York, Massachusetts, Illinois, Oregon, Texas and Washington. However, many of these pilots are still extremely small scale and are unnecessarily complex and entangled in webs of outdated regulations — we are stuck in purgatory between current regulations designed to manage programs that pay in advance and future markets where aligning incentives means regulators can focus on sending the right price signal and prevent abuse and gaming.

Steps to reach scale

The transition from programs to markets is not a one step process. It requires a series of investments in data and a cultural shift from regulators and utilities toward adopting financial principles of portfolio management. This transition will take time and data, so it’s critical that we get the ball rolling immediately:

- Utilities should implement open source metering of energy efficiency performance in order to optimize program implementation and make savings and resource curve data open and transparent.

- Utilities should create pay-for-performance pilots next to existing programs, allowing third party aggregators to innovate and compete based on outcomes.

- Regulators should allow utilities to recover cost so long as the utility cost of metered efficiency is lower than the marginal cost of alternative resources.

- Regulators and utilities should move efficiency resource curves into all resource procurements alongside other distributed resources.

Given the problems faced by the changing grid, and the market and financial barriers to scale inherent in the current approach to energy efficiency, it is urgent that we start aggressively standing up markets that value energy efficiency resource curves through pay-for-performance, to unlock private investment and market innovation.

The good news is that solutions exist to overcome efficiency’s existential challenges and deliver the investment needed to achieve the vast potential of energy efficiency. The sooner we pivot the better — there is no time to waste.

Matt Golden is the CEO of Open Energy Efficiency and a guest author for America’s Power Plan.